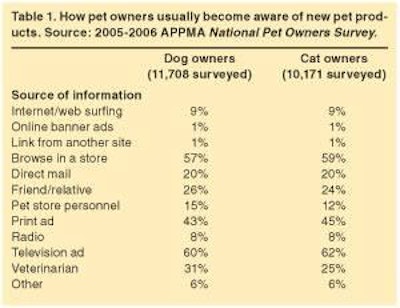

The 2005-2006 version of the American Pet Products Manufacturers Association's (APPMA) National Pet Owners Survey has been released. According to the survey, pet owner awareness of a new pet product via the Internet has increased from 8% to 9%with web surfing being the primary source of awareness. Increased awareness via the Internet creates problems for other mediums that typically created new product awareness in the past.

Specifically, television ads (1-2% decline since 2002), print ads (1% decline since 2002) and direct mail ads (3% decline since 2002) all experienced declines in their ability to create awareness of new pet products. Conversely, both "friends/relatives" and "browsing in a store" showed modestly higher levels of being a source of new pet product awareness. Table 1 shows the sources of new pet product awareness for dog and cat owners.

Media habits

The media source used most during an average day is television (watched three hours a day). Pet owners will spend two hours each day on the Internet and listening to the radio. Only one hour per day is dedicated to reading newspapers and magazines. Media habits are comparable across all pet owners (dog, cat, fish, bird, small animal and reptile). This survey found that more pet owners are involved in these activities than non-pet owners.

Among those shopping online for pet products, pet owners who use the Internet are younger than shoppers who read either a magazine or newspaper. Regardless of the activity a pet owner is involved with, the sex of the primary shopper for pet products is typically female.

Approximately US$28 is spent each time a pet owner shops online for their pet. It is expected from the survey data that pet owners will shop the Internet three times in the next 12 months for a pet product.

Food purchases

When asked what type of food owners purchased in the last 12 months, premium dog food and dog food fortified with vitamins or minerals continue to be the most prevalent types, with the former served most often. There is a significant increase (from 7% to 12%) among owners feeding dogs food fortified with supplements. In contrast, there is a significant decrease (from 30% to 23%) for owners feeding their dog human food. One percent of dog owners have bought kosher dog food in the past 12 months. Kosher dog food is purchased more often in households with young children and those living in the Southern region of the US. Dry dog food continues to be the preferred form, regardless of type.

According to the survey, cat food fortified with added vitamins or minerals (such as calcium or vitamin E) has been purchased by 34% of cat owners, with most considering it the type of food they use most often. Premium cat food has been purchased by 33% of cat owners, with the majority of those buying it also considering it the food type they use most often. Two out of ten (up from 17%) buy gourmet cat food, but only half of those buyers used that type most often. Frozen cat food and kosher cat food did not register as having been bought in the last 12 months. Canned cat food continues to be the kind of cat food used most often among gourmet cat food buyers. Owners buying dry cat food prefer cat food fortified with added vitamins or minerals and premium cat food, while users of semi-moist food (of which there are very few) prefer frozen cat food.

Get your copy

To purchase your own copy of the 2005-2006 APPMA National Pet Owners Survey, contact the APPMA at Tel: +1.203.532.0000, Fax: +1.203.532.0551, Website: www.appma.org.